what happens to irs debt after 10 years

Specifically Internal Revenue Code 6502 Collection After Assessment limits the IRS to 10 years to collect a tax debt. The IRS cant try and collect on an IRS balance due after.

Tax Relief Questions And Answers Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What happens after 10 years of owing the IRS.

. Unfortunately that 10-year timeline is. After that the debt is wiped clean from its books and the IRS writes it off. To accomplish this on.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. As already hinted at the statute of limitations on IRS debt is 10 years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

After that the debt is wiped clean from its books and the IRS writes it off. However some crucial exceptions may apply. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Does the IRS forgive back taxes after 10 years. This is called the 10 Year. What happens to a federal tax lien after 10 years.

Is IRS debt forgiven after 10 years. After that the debt is wiped clean from its books and the IRS writes it. If this is the first time youve owed the IRS money you can request a first-time abatement.

After the 10 year statute of limitations on collections expires the IRS is required to release the lien. Many people feel tempted to wait out the 10 years to not pay the debt. After this 10-year period or statute of.

This is called the 10 Year. However the waiting it out strategy is. What happens after 10 years of owing the IRS.

Yes indeed the length of time the IRS is allowed to collect a tax debt is generally limited to ten years according to the statute of limitations on. As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. Limitations can be suspended. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

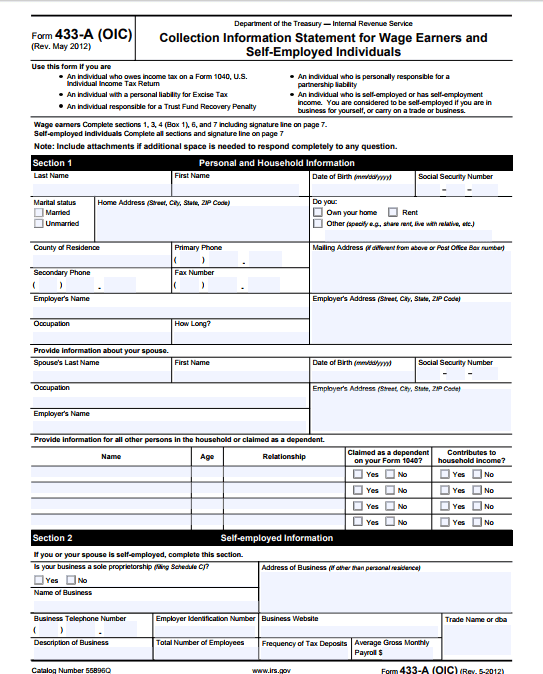

The IRS considered the pending installment agreement in effect for the whole time period 5 years and now the IRS has 15 years to collect the tax debt. The IRS has a decade to collect a liability from the date of assessment. If you have received a 1099-C for a debt forgiven after the debts statute of limitation has run out 6 years in most states technically that money is not income.

If you prove to the IRS this is the first time you have been in a. The 10 years starts at the debt of assessment which is. After 10 years the IRS can write the debt off and clear it from their books.

If you prove to the IRS this. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt. After that the debt is wiped clean from its books and the IRS writes it off.

Tax Refunds In America And Their Hidden Cost 2020 Edition

Does The Irs Forgive Tax Debt After 10 Years

4 Options For Paying Or Dealing With Your Tax Debt

Trump S Tax Plan Would Add 24 5 Trillion To The Debt Concord Coalition

Are There Statute Of Limitations For Irs Collections Brotman Law

Tax Debt And 10 Year Statute Of Limitations Wilson Rogers Company

Irs Tax Debt Attorney Pelley Law Office Plano Tx

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Does The Irs Forgive Tax Debt After 10 Years Sort Of Tax Attorney Explains Expiring Tax Debts Youtube

Does Irs Debt Go Away Yes But It S Not That Simple Lendedu

What Is The Irs Debt Forgiveness Program Tax Defense Network

Irs Debt Forgiveness Program Here S How To Apply Supermoney

2020 Guide To Getting Free Help Filing Paying Irs Back Taxes Forget Tax Debt

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

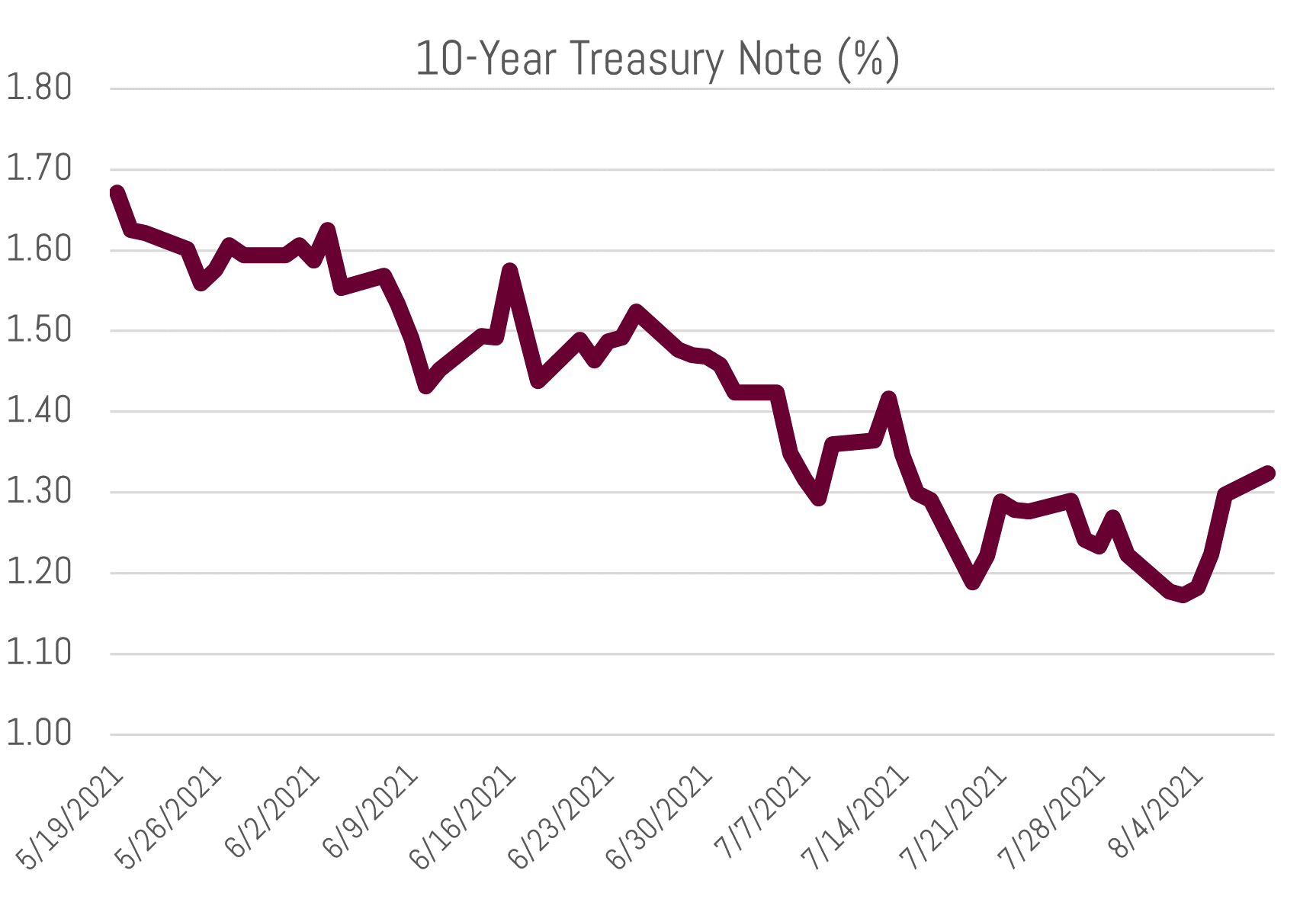

Market Summary Relative Value Of Municipal Bonds Bernardi Securities

Fy 21 22 Budget News 1 56 Tax Increase Orange Town News

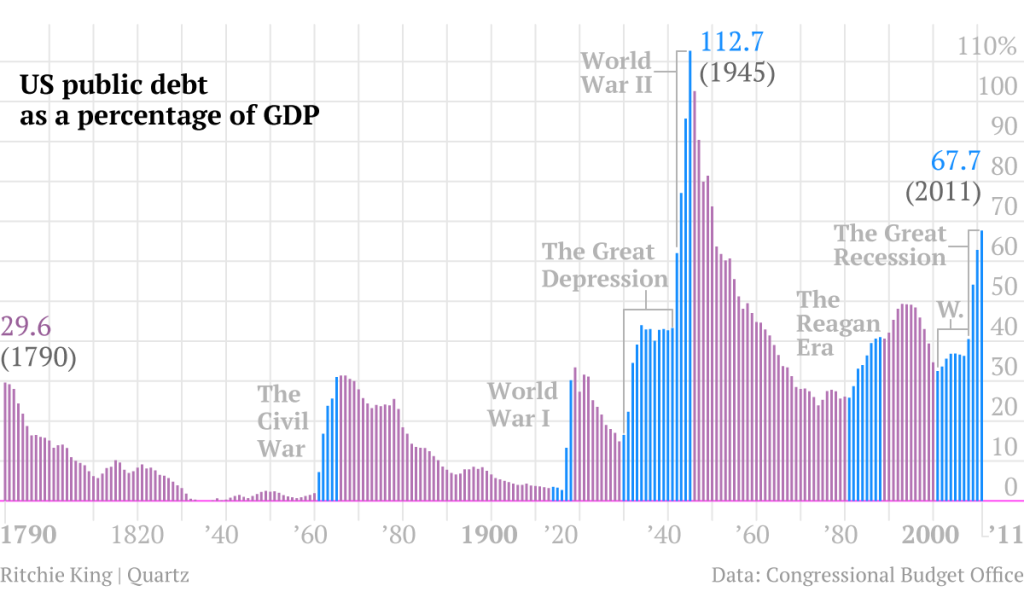

The Long Story Of U S Debt From 1790 To 2011 In 1 Little Chart The Atlantic